NORD/LB is one of Germany’s leading commercial banks. As a public-sector institution, it is part of the S-Finanzgruppe (S-Financial Group) and is considered one of Germany’s nationally systemically important banks.

The bank’s headquarters in Hanover, Braunschweig, and Magdeburg mark its roots in its parent states of Lower Saxony and Saxony-Anhalt. NORD/LB looks back on a centuries-old tradition.

As a commercial bank, it offers its corporate and institutional customers, as well as public-sector customers, a targeted range of financial services. It is also active in the private customer business through Braunschweigische Landessparkasse (an institution within a bank – AidA). It maintains a global presence through branches and representative offices in all major trading centers, including London and New York.

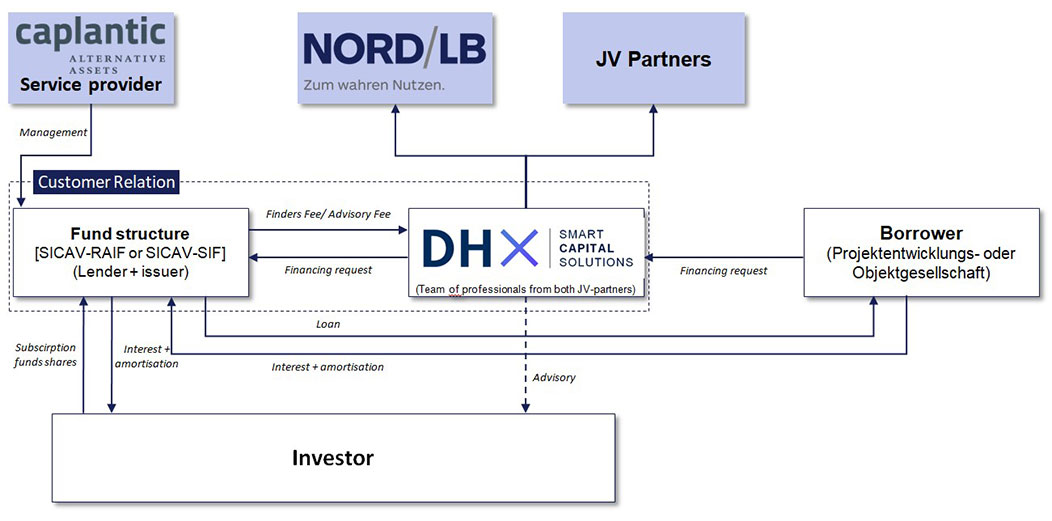

NORD/LB holds a 100% stake in Caplantic GmbH. Caplantic GmbH operates in the alternative assets sector as a service provider, risk manager, and portfolio manager. The company’s services include the structuring, support and risk management of investment products in illiquid asset classes such as aircraft, ship and real estate financing, as well as infrastructure and renewable energies.

Through its initiators, DHX Capital Solutions GmbH has a long-standing track record in the successful brokerage and structuring of mezzanine and subordinated capital, combined with the provision of equity tranches in the real estate sector. As a brokerage platform, it brings together the various stakeholders and ensures the alignment of the various parties’ interests.

This proven track record is, in turn, closely linked to the management company of Rainer Göbel and Gerd Kremer, which stems from the history of the long-standing, successful real estate asset manager GLL. Both men built up GLL Real Estate Partners, Munich, as managing partners and co-founders.

GLL is internationally renowned and successful as a specialist service provider for institutional real estate funds. Currently, approximately EUR 11 billion is held and managed with more than 100 properties in over a dozen individual and multi-investor funds by 170 employees with offices in Europe, North America, and South America. In 2018, the Australian investment group Macquarie Group acquired GLL and integrated it into its group.